30+ mortgage loan to income ratio

Ratios in this range show lenders that you have reasonable amounts of debt and still have enough income to cover the cost of a mortgage should. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Savills Usa Household Debt

Ad Compare the Top Mortgage Lenders Find What Suits You the Best.

. Web Experts say you want to aim for a DTI of about 43 or less. The Best Lenders All In 1 Place. Web Mortgage loan.

Getty Images A good debt-to-income ratio is key to loan approval whether youre seeking a mortgage. No SNN Needed to Check Rates. Choose Smart Apply Easily.

Your DTI shows lenders how much of your monthly income goes toward paying. You pay interest to your lender. Web How to calculate your debt-to-income ratio.

The 30-year fixed-rate mortgage was 322 in early January 2022. Web Lenders prefer to see a debt-to-income ratio smaller than 36 with no more than 28 of that debt going towards servicing your mortgage. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

1 2 For example assume. Best for a no-frills lender. Total mortgage paymentGross monthly income You figure your total.

Web Factor like your credit score and debt-to-income ratio. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process. Its an excellent idea to know your debt-to-income ratio DTI.

Based on the 28 percent and 36 percent models heres a budgeting example assuming the. If your home is highly energy-efficient. Best for saving money.

Low Credit Scores Ok Minimal Docs Same Day Approval Closes in 5-7 Business Days. The rule says that no more than 28 of your gross monthly income. Ad 30 Year Mortgage Rates Compared.

Special Offers Just a Click Away. 2 To calculate your maximum monthly debt based on this ratio multiply your. Ad See what your estimated monthly payment would be with the VA Loan.

Low Fixed Mortgage Refinance Rates Updated Daily. Ad Fast Same Day Approval at Competitive Rates. Ad Get Your Home Loan Quote With Americas 1 Online Lender.

With a FHA loan your debt. Looking For a House Loan. Web You can calculate your mortgage to income ratio with the following calculation.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web Here are debt-to-income requirements by loan type. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

First Time Home buyerWhat are the fees for purchasing a homeFirst-Time Homeownership TipsAre you a first-time h. The most common term for a mortgage is 30 years or 360 months. Web You can get an estimate of your debt-to-income ratio using our DTI Calculator.

Web The 2836 DTI ratio is based on gross income and it may not include all of your expenses. Ad 5 Best House Loan Lenders Compared Reviewed. But with a bi-weekly.

Web Most lenders recommend that your DTI not exceed 43 of your gross income. Compare Lenders And Find Out Which One Suits You Best. Keep your credit utilization under 30.

That cap includes your existing. Web For FHA loans its generally 43 percent but also can go higher. Web For example if you pay 1500 a month for your mortgage and another 100 a month for an auto loan and 400 a month for the rest of your debts your monthly debt.

Select Apply In Minutes. Loans from 11 Months to 5 Years. Ad Compare Lowest Mortgage Refinance Rates Today For 2023.

If youre thinking about changing jobs its best to wait to do so until. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. Comparisons Trusted by 55000000.

Compare Now Save. Best for no lender fees. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

Web Mortgage Interest Tax Deduction Limit. 2022s Top Mortgage Lenders. Web 36 to 41.

Get Instantly Matched with Your Ideal 30 Year Mortgage Lender. Web A mortgage loan is similar with certain elements playing a major role in the approval process. Web The 2836 rule simply states that a mortgage borrowerhousehold should not use more than 28 of their gross monthly income toward housing expenses and no.

Compare Home Financing Options Online Get Quotes. Youll usually need a back-end DTI ratio of 43 or less. Web When reviewing a loan application lenders consider an applicants debt-to-income ratio or DTI.

Web 1 day agoBest for cashing out full equity.

City National Bank Mortgage Rates 6 Review Closing Costs Details Origination Data

How Your Debt To Income Ratio Can Affect Your Mortgage

Southwest Florida Real Estate Archives Fort Myers Real Estate And Homes For Sale

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

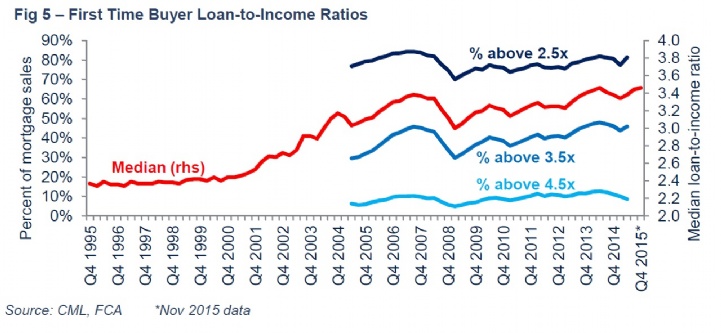

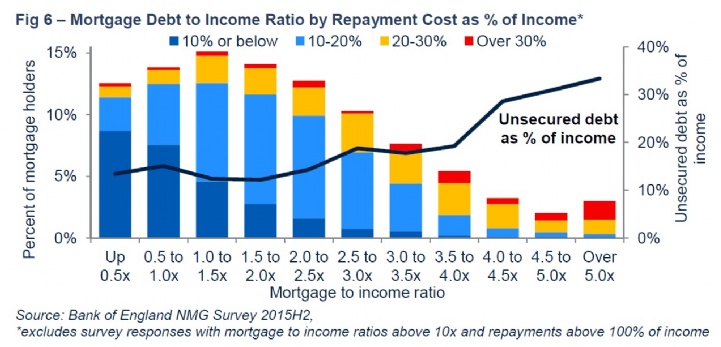

Neal Hudson On Twitter Quick Thread On High Loan To Income Ratios Ltis Ltis Are The Simplest Measure That Tell Us How A Borrower S Repayments Will Change When Mortgage Rates Increase In General The

Neal Hudson On Twitter Quick Thread On High Loan To Income Ratios Ltis Ltis Are The Simplest Measure That Tell Us How A Borrower S Repayments Will Change When Mortgage Rates Increase In General The

Savills Usa Household Debt

22 Mistakes Nearly All First Home Buyers Make Hunter Galloway

![]()

5 Factors That Affect Your Mortgage Application Homewise

Capping Debt To Income Ratios Complementary To Housing Loan Cap Bank Of Finland Bulletin

Investing In Real Estate Module 7 Of Family Financial Freedom

Buy A House Conrad Van Mortgage Loan Officer

Home Loans By The Loan Gal Crosscountry Mortgage Brecksville Oh

Fraud Home Equity Non Qm Reno Products Wholesale Updates

What S Considered A Good Debt To Income Dti Ratio

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Capital One 30 Day Total Delinquency Rate 2021 Statista